Mint has been reimagined on Credit Karma.

Mint has been reimagined on

Credit Karma.

Reviewing transactions, monitoring your spending and tracking your net worth now have a new home.

Check it out

Popular Mint features have made the leap to Credit Karma

to help you grow your money.

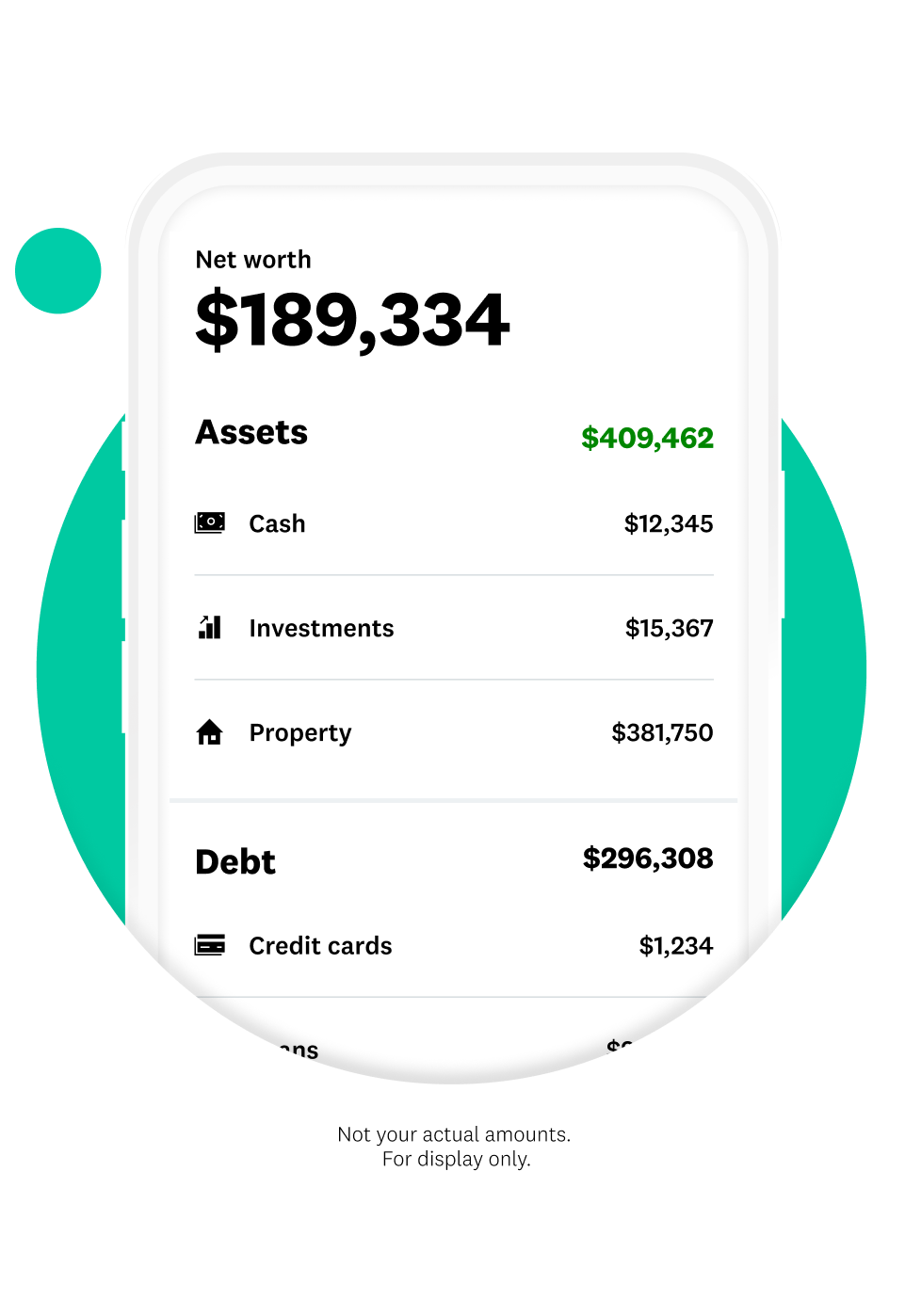

Keep tabs on your

money in one place.

Link your accounts from more than 17,000

financial institutions and view your connected

transactions across them in

one place.

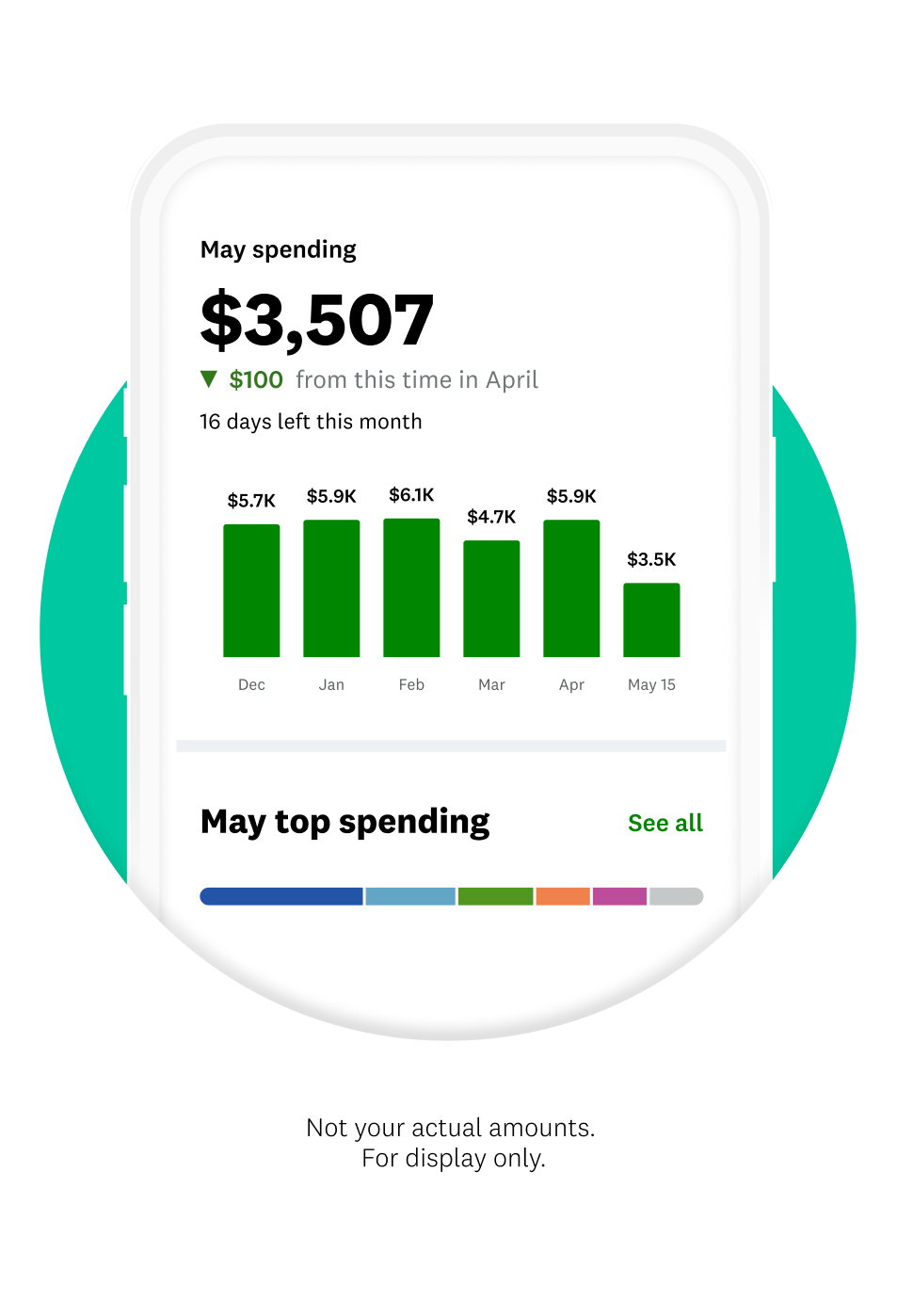

Track your monthly spending and more.

Review your transactions, track your spending by category and receive monthly insights that help you better understand your money habits.